Bob

Simmons: Oil Wildcatter

(OK, so Norman

asked me to write something about how I got out of radio and into the oil

business. Fair question. How did a

San Francisco radio hippie end up in an andeluvian business like this? What’s

it like being a leftie amongst the Bushite Neanderthals? But if you know

anything about who I was before I became a pot-addled hair tree in Northern

California, then it is not all that far-fetched.)

I was raised in

North Texas in a place called Wichita Falls.

Wichita Falls was a feudal town run by a few local wealthy ‘oil

families’. The entire economy,

other than that which depended on the local Air Force base, was based on the

Independent oil business. My dad was a doctor there, so we were still servant

class. I had a couple of summer

jobs in the early Sixties that involved driving a truck from a supply yard out

to the operating oil rigs near Archer City. (Home of Larry McMurtry and star

location of “The Last Picture Show.” That movie looked very much like what I

remember of North Texas, though it was set in a decade previous to mine.

Things changed slowly in that dusty mesquite filled world.

You cannot be reared in that environment and not know something of the oil business. You take in concepts like: mineral rights, leases, royalties, geology, and the price of oil and gas almost by osmosis. You learn the cost of a pump jack, say a Lufkin 160, or the going rate for sucker rods. You learn what the average lease bonus is for a two year, 1/5th mineral lease, or what HBP means, or the difference between a farm-out and a farm-in. One just learns this stuff. You can leave North Texas, but the knowledge remains. You can take the boy out of the oil patch, but.

So,

fast-forward twenty years to 1983. I

returned to Texas after almost twenty years in radio on the West Coast.

I came back to Austin ostensibly to be the publisher of a local hippie

tabloid. As things turned out, the

reasons I had been brought in were not quite what I had been led to believe.

Things unwound, new friends and new enemies were made. And I suddenly needed

another job. An old pal was just

quitting his marketing job with a local oil company. “Hey Bob, I am giving up my job over at BlahBlah Energy.

Why don’t you go talk to them?”

Why not, I thought. Bang!

1984 didn’t mean George Orwell to me; it meant I was in the trenches doing

something I never thought I would do. Selling

oil deals. Let’s see, why did I leave Texas?

So I wouldn’t have to do this?

So,

fast-forward twenty years to 1983. I

returned to Texas after almost twenty years in radio on the West Coast.

I came back to Austin ostensibly to be the publisher of a local hippie

tabloid. As things turned out, the

reasons I had been brought in were not quite what I had been led to believe.

Things unwound, new friends and new enemies were made. And I suddenly needed

another job. An old pal was just

quitting his marketing job with a local oil company. “Hey Bob, I am giving up my job over at BlahBlah Energy.

Why don’t you go talk to them?”

Why not, I thought. Bang!

1984 didn’t mean George Orwell to me; it meant I was in the trenches doing

something I never thought I would do. Selling

oil deals. Let’s see, why did I leave Texas?

So I wouldn’t have to do this?

A week later I had sold my first partial interest in a well being drilled by the Mutable Ethics Oil Company. (Not true name) Some hapless dentist now owned a share of a well that would be lucky to make its original investment back in three years if ever. He got his tax break, and I got my commission. I could get rid of the eight hundred dollar car I was driving and move up to a five year old Honda. Oddly, at the time I didn’t know I was selling shitty deals. I wouldn’t have known good geology or a good prospect from a map of Vanuatu.

We drilled the

wells, and the worst of all possible worlds for the investors would happen, we

would make a good well on a crappy prospect. That is, we would make a 3 bbl a

day well… just enough to justify the completion, but hardly strong enough to

ever really make anyone any money… other than the promoters of course. Well,

it was a learning experience at least.

After a few months

of this, an old pal of mine from high school days who was in the real oil

business in North Texas said, “What the fuck are you doing selling those crap

deals?

After a few months

of this, an old pal of mine from high school days who was in the real oil

business in North Texas said, “What the fuck are you doing selling those crap

deals?

Let’s go up to Denver and get a real prospect. You proved you could sell garbage, why don’t we sell something real?” And so we did. We met with a retired geologist from

Cities Service who offered us a wildcat in the Denver Julesburg Basin. It was a rank ass wildcat1, but with enough information on it to make it obvious that it was about a one in five chance of hitting, but if it did, it would make about $50 million dollars. Lock and load, Jimmy! Fire up that telephone. I had learned how to prospect for potential deal buyers and I had a boxful of contact cards in my desk. Ring. “Hello, Dr. Do you remember when you said to call you if we found anything that looked promising. Um, I think we have something here.” In 30 days I had raised the $180K we needed to drill. And drill we did. Dry! Dust! Nada. Zip and zilch. ‘Oh, well’ took on new meaning. Everyone took their lumps like the machos they were. Next!

So I decided to

stay closer to home. No strange D-J

Basin. There was a big play going

on south of Austin in what was called the Austin Chalk. I had been doing a lot

of reading and going to UT’s geology library, and I can tell you, if there is

one thing The University of Texas knows about, it is oil and oil resources. I

zeroed in on a town just south of Austin called Gonzales, Texas.

There was a bunch of old Austin Chalk wells in the area, some of which

had been prolific. Some, not so. What a freakin’ crapshoot. I managed to get a

lease from a local dairy farmer and I went to work trying to put together a new

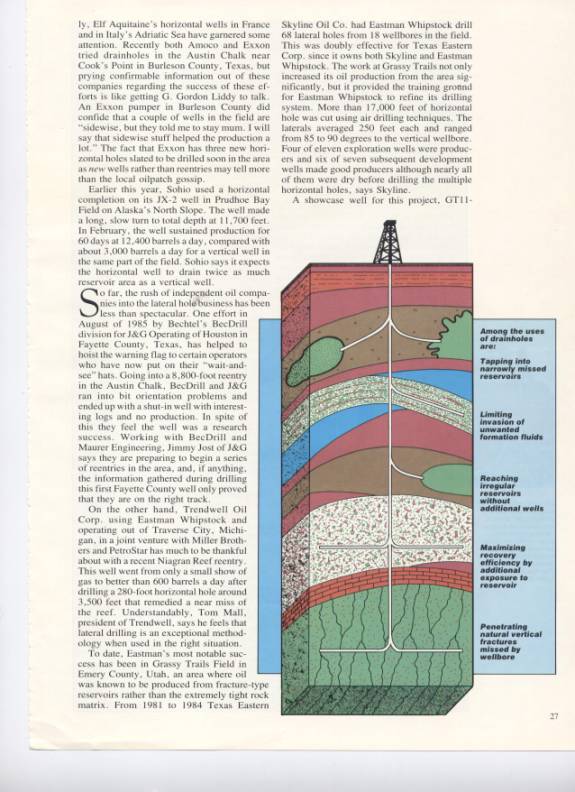

kind of deal. This was by now 1985, I had been reading in the UT

Engineering School’s tech trade library about a new form of ‘horizontal

drilling’ that they had been doing offshore in Italy.

It was a way of taking a normally vertical drill string and slowly

deviating it while drilling so that by the time it reached the productive

formation it was literally moving sideways through the rock rather than coming

down vertically from the top. This

technique was proving to be quite effective for this type of rock, which

coincidentally happened to have many of the same characteristics of Austin

Chalk. Hmm. I thinks to myself. There

needs to be further research here. Lo

and behold, the more I found out, the less farfetched the idea was.

It just so happened a couple of the major oil companies in south Texas

were experimenting with the same technique.

So I wrote about my

research and managed to get it published in a relatively influential Oil and Gas

magazine. It was my new ticket to the game. Now when I called some of the same

people back, I had a story hardly anyone else could tell.

It was true, horizontal

drilling

was making ‘carbonate formations’ give up more than 3x on average more oil

than a conventionally drilled and completed well. Cool! If ‘not being poor

anymore’ was going to be a goal, this was going to be my ticket out of the

media palookaville I had worked my way into.

drilling

was making ‘carbonate formations’ give up more than 3x on average more oil

than a conventionally drilled and completed well. Cool! If ‘not being poor

anymore’ was going to be a goal, this was going to be my ticket out of the

media palookaville I had worked my way into.

I went to work

organizing my own little exploration company. Never mind that I didn’t know

doodly squat about drilling a well, I figured there were plenty of people around

I could hire once I got the money together around the idea I was pushing.

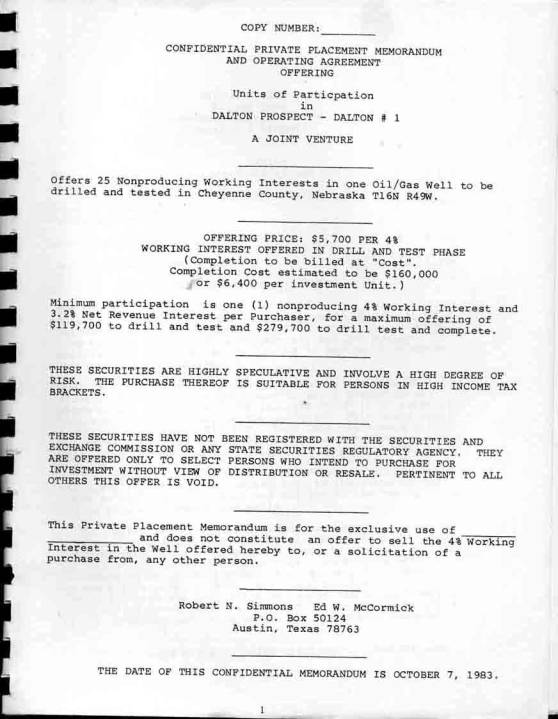

I wrote a two hundred page investment prospectus, I re-did a Producer’s

88 drilling contract, did my research in Texas securities law, and generally

worked my ass off. When all the paperwork was in place and I had found myself a

drilling contractor and had worked out a deal with the horizontal

drilling-by-measurement company, Norton Christianson, Inc., and, I had filed

with the Texas Securities Board my Regulation D requirements, and, and, and… I

was ready to sell the deal.

My first investor was a big one, a guy named Raul Casso, (now deceased, but bless his soul anyway) of Laredo, Texas. He owned some internationally bonded warehouses and duty free stores. Raul was ready to take a quarter of the deal. We had figured the AFE (authorization for expenditure) to be about $750,000 (little did we know) to drill to total depth and log. We went down to San Antonio to meet him at the private aviation terminal. He was getting off of a Gulfstream II. At the time, that was about a $4 million plane. We figured he was doing OK. Meanwhile I couldn’t even pay my phone bill. Raul had read all the materials and he handed me a check for $150,000. It felt like it weighed 100 pounds. He showed us a bag of diamonds. He said he was on his way to Amsterdam to sell them. We didn’t ask questions. We didn’t care how our backers made their money.

Within a couple of

months I had raised close to half a million dollars… all the while, (I should

have been paying closer attention) the price of oil was plummeting. When I

started in the oil game oil had been up to $30 a bbl, by fall of 1985 it had

fallen to $11.

I was dead. My

company came to a screeching halt. So I took all the money that I had so

painstakingly gathered and I sent it back to the investors with a thank you

letter. My little oil company was

going back on the shelf for the next twenty years.

All followed by- a long period of Radio & TV speculation, a marriage, an Operatic Costume business. (wha???!) 3 years in the Internet biz in Costa Rica. A long visit to Cuba. A lot of traveling and a lot of layin’ around.

Which brings us to

now.

A couple of years ago, I started believing that the United States was being run by worse liars thieves and crooks than usual. My rationale was that there was no way a country being managed this way was going to maintain value of its currency. Inflation was being lied about in all the government statistics but one, the one they couldn’t control, the international value of the US dollar. When I saw the dollar dip below the value of the Euro for the first time, and then continue its slide, I thought to myself, man, the worst place to be in any investment is US cash. If you were holding dollars in 2001, then the true purchasing value of your dollar has plummeted almost 50% thanks to George Bush and his neocon pals. Hmm. How will I get out of this trap? “Oh, look what is holding its value! In fact, with diminishing production, what is becoming more and more valuable?

It is my old friend/enemy, the mother of all commodities, oil and gas. Time to dust off the shelf and get back to it.

So here I am…. Back in the patch.

Luckily, I have found some partners whom I trust and who know a lot more than I do. We are now three successes out of four. I actually mortgaged my house in order to get the money to go into the wells that are now treating me nice.

As the old saw goes, you have to speculate in order to accumulate. I would never have taken a chance like this if I didn’t feel like I knew a lot more about what I was getting into than I had in the past. So far so good. There is a lot of money still to be made in domestic onshore exploration and production. I only want enough to last the rest of my short life and to make my daughter safe and educated. I wouldn’t mind a few meals in Rome and Paris in the meantime.

Geologist nonpareil, Wilford Stapp. Yours truly, Le Telebob, and John Mullins, true oil genius.

Our honeypie.

Maybe next time Norman will have the sense to not ask me to tell you what I have been up to. I would still rather be playing music that makes me feel good to a city full of people who like what they hear. Sometimes music actually makes us better people.

(That’s why someone I know has a pirate FM on the air at 95.1 Me? God forbid I would break FCC laws and regulations. I mean they are such an honest agency of our Federal Government.)

Meanwhile…. Get out of your car. Save oil. Make me find another business.

Next week…. The

story of Bob in the Opera Costume Business or the story of Bob in the small

radio station owner broadcasting business. Or how I learned to hate Ross Perot

and former governor of Texas Mark White.

1 Wildcat- a well that is not known to be near presently producing oil fields and thus a higher risk prospect.